To be clear, we’re not in a recession yet. But recession indicators are popping up left and right, and I’m not just talking about Lady Gaga singing gobbledy-gook in her choruses again (Porta ooo Gaga!). A Wednesday press release confirmed the U.S. gross domestic product went down in Q1, the first time in three years to do so, and a CNN/SSRS poll published earlier this week found that two in three adults are fearful about the economy.

For young queer people, the one-two punch of dramatic recession headlines and anti-LGBTQ+ political vitriol can feel scary. It’s already tough out there in the job market; is it really going to get tougher? Maybe. Gen Z is stressed, and with one in five of them identifying as queer, they make up a hefty chunk of our community. Millennials and older generations should do what we can to share our experiences with young people and help them feel empowered when “Recession Bayonetta” (terrifying) is on the horizon.

Here are four recession prep tips that still let you live a life you love.

1. Budget like a boss

Take the encyclopedic knowledge you have about the cast of RuPaul’s Drag Race or Below Deck and bring that same enthusiasm to your budget. Get a grip on how much money comes in and goes out every month. Actually look at your money on a regular basis (gay gasp). Consider a free budgeting app that connects to all of your accounts so you can see everything in one place. When I started monitoring where all my money went each month, I stopped trying to keep up with the Joneses and focused on what lights me up in life, which has made my queer joy much more sustainable.

Also be mindful about using Buy Now, Pay Later (BNPL). It can be tempting to spread out your bill over four payments, but it’s also easy to lose track of what you owe to whom and when if your budget tracking isn’t airtight. A recent survey from LendingTree found that 41 percent of BNPL users had at least one late payment in the last year, up from 34 percent the year prior.

2. Develop new job skills

I went to college for classical music, and let’s just say demand for professional orchestra musicians did not explode during the last recession (or any recession). I’m 38 now; my hot take is that there is no perfect college major, that the world evolves rapidly, and that lifelong learning and personal development are more valuable than a strong report card or a fancy piece of paper.

What college did teach me was how to think critically and learn new things quickly, and in many cases these skills around rapid learning are what have kept me sharp. Look into continuing education classes online or at your local community college. If the education relates to your current job, you might also be able to pitch your employer to help pay for it. Learning new and different skills can help you recession-proof your career as the economy shifts.

3. Cut down on streaming services

Summer’s almost here, ya silly goose! You don’t need all those streaming subscriptions. Subscriptions have crept up considerably in the last few years, so you might be paying more than you realize.

Many streamers give a special offer when you try to cancel, such as 3 months at half price. Look into this for all your subscriptions to save a few bucks. If you accidentally follow through and cancel, but didn’t want to, just sign back up. Small budget wins like these are easy and productive, and every dollar helps.

4. Swap doomscrolling for delight

While we’re on the subject of streaming, I want to remind you that social media platforms incentivize drama, and that if you’re stressed about the economy right now, hours of doomscrolling will only make these feelings worse. There’s a reason both media outlets and creators tend to sensationalize the news: It works. Focus on facts and what you can control today.

See if you can stay informed while also putting a cap on social media consumption. How about charging your phone on the opposite side of the bedroom so that you can’t reach for it first thing in the morning? Take baby steps to clean up your digital hygiene.

Then, reinvest this time in some other hobby that feels good and gives your brain a break. Get a library card, discover the different parks in your area, or host a queer board game night with your friends. No one cares if you have nice furniture (or any furniture); it’s about cultivating community and belonging, which is something we all need right now.

Recessions can be tough, but they’re not the end of the world. They might affect you a lot, or barely at all, and my crystal ball is in the shop for maintenance, so we can’t predict the future. Learn how to cultivate queer joy when finances are challenging and you’ll have the resilience you need for the potentially rocky road ahead.

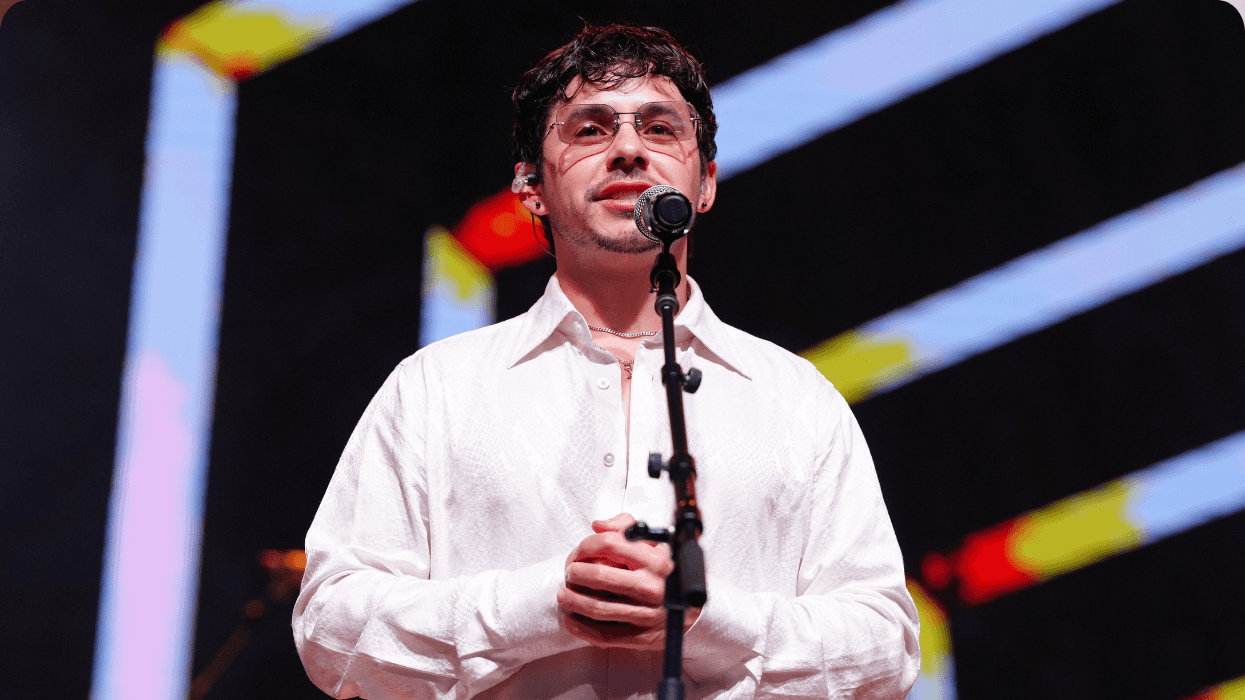

Nick Wolny is Out magazine’s finance columnist. He writes Financialicious, a personal finance newsletter tailored toward queer readers, and is working on his first book, Money Proud, which releases later this year. NickWolny.com @nickwolny