You’re fabulous. But your credit card debt is keeping you fabulously broke, and other payment options like "Buy Now, Pay Later" (BNPL) are probably making things worse. Let’s fix that.

Credit card debt in America broke another record last month, with our collective damage now over $1.2 trillion, the Federal Reserve Bank of New York’s most recent Household Credit and Debt Report found. It’s the seventh time in eight quarters the record has been broken, and since this number doesn’t include any money loaned through BNPL services like Klarna and Afterpay, our actual debt burden from month to month is probably higher.

Debt keeps his boot on our chest month after month, and not in the playful-kinky kind of way. It’s a pressure that is uncomfortable at best and destructive at its worst. In a 2023 survey, 48 percent of LGBTQI+ people reported having over $10,000 in personal debt. For one in five, the burden was over $50,000. Combine these balances with queer people’s higher levels of poverty and lower levels of savings, and you have a money muck that can be difficult to escape. Even if you’re making ends meet, the next few months can get expensive for queer people (only 86 more sleeps until Pride month!), so it’s best to get your financial shit together sooner rather than later.

To be clear, debt itself is not bad. Debt is a tool that, when used properly, can give us leverage to pursue big life moments, like buying a house or car, or starting up a business. When the interest rate on your debt is high, though – and for credit cards, it’s “Ariana Grande’s falsetto” high, currently averaging over 21 percent – simply maintaining a balance from month to month will eat away at your purchasing power.

In recent years, Buy Now, Pay Later has presented itself as an interest-free alternative to credit cards. There are no interest rates; instead, your balance gets chopped up into four equal payments, usually over a six-week period (Basically, an in-the-moment personal loan). But because you don’t always receive notifications about upcoming payment installments, it can be easy to lose track of what will come out of your bank account and when. If your cash flow is tight, you might not be able to make a payment, which means you’ll be slapped with a late fee on top of your checking account having a big, fat zero – not cute.

We don’t have a lot of consumer data about BNPL, but what’s been trickling in so far doesn’t look great. Last year, a Harris Poll from Bloomberg found that a third of respondents using BNPL had more than a thousand dollars out on the service, 43 percent of the borrowers were behind on the payments, and 28 percent were behind on other debt payments. Credit card debt and BNPL together create a one-two punch that has many of us feeling financially stuck.

Queer people have enough stress in their lives right now. Instead of letting your messy money add to the chaos, consider taking a few steps to get yourself back on track.

First, if you haven’t actually looked at your bank accounts in a while, I need you to start doing that on a regular basis. You’ve got this. Channel some of that coming-out courage, open those apps, and get clear on what you’re workin’ with. How much is coming in? How much is going out? You might discover expenses you didn’t even know you had, which you can then trim out for some quick wins.

Next, create enough cushion in your checking account that you aren’t tempted by that sexy-ass BNPL button. BNPL does not save you money; it delays reality, and sadly our lives aren’t a David Lynch movie, so I need you operating in reality to regain control of your cash. This will help you keep track of where your money is going and how much you have to work with each month. If you don’t have enough to work with, consider picking up some gig work or a side hustle to close the gap, or start angling for a new job.

Third, if you’ve been swimming in credit card debt for a while, formulate a plan to pay it off. Size doesn’t matter, but if you must know, the average credit card balance last fall was about $7,200, according to data compiled by LendingTree (Translation: You’re not alone). If you’re overwhelmed by all your different accounts and payment due dates, consider working with a bank to do a debt consolidation loan. Yes, the initial organizing will suck in the short term, but please don’t let debt take over your life to the point that it’s sabotaging your mental health. There are ways to get help.

The category is transparency, and avoidance is so 2024. When the world feels on fire, focusing on what you can control can actually bring you peace and solace. Start taking action now so that you cultivate confidence and momentum – qualities that come in handy when the future is uncertain.

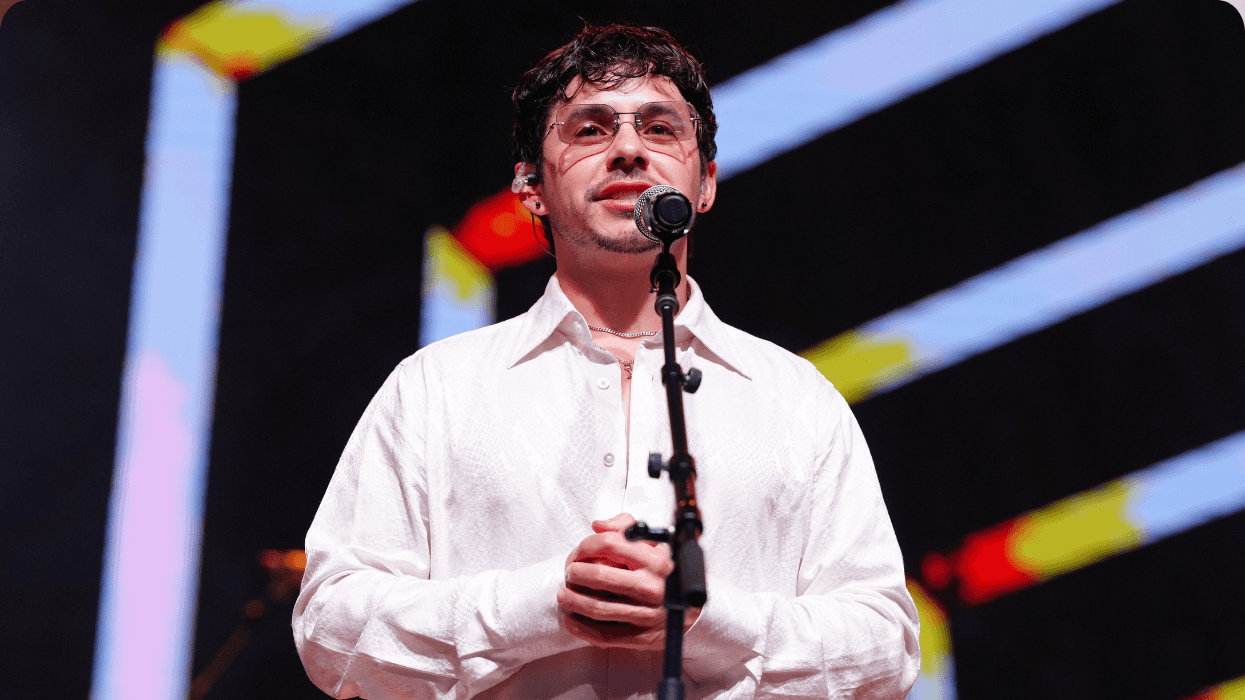

Nick Wolny is Out magazine’s finance columnist. He writes Financialicious, a personal finance newsletter tailored toward queer readers, and is working on his first book, Money Proud, which releases later this year. NickWolny.com @nickwolny