Eighteen months ago, when I first announced my book deal on LinkedIn, I was met with your typical batch of finance bro haters. (I know, I know — mistake number one was hanging out on LinkedIn in the first place.)

“WhY iS mOnEy AnY dIfFeReNt FoR LGBTABCD pEoPlE?” commented one troll. At first glance, he was right — money itself isn’t different for queer people. Our lives, however, are very different, full of unique stressors and cultural nuances we navigate on a daily basis. These experiences and the various thought patterns and behaviors you develop along the way shape your financial well-being more than you realize.

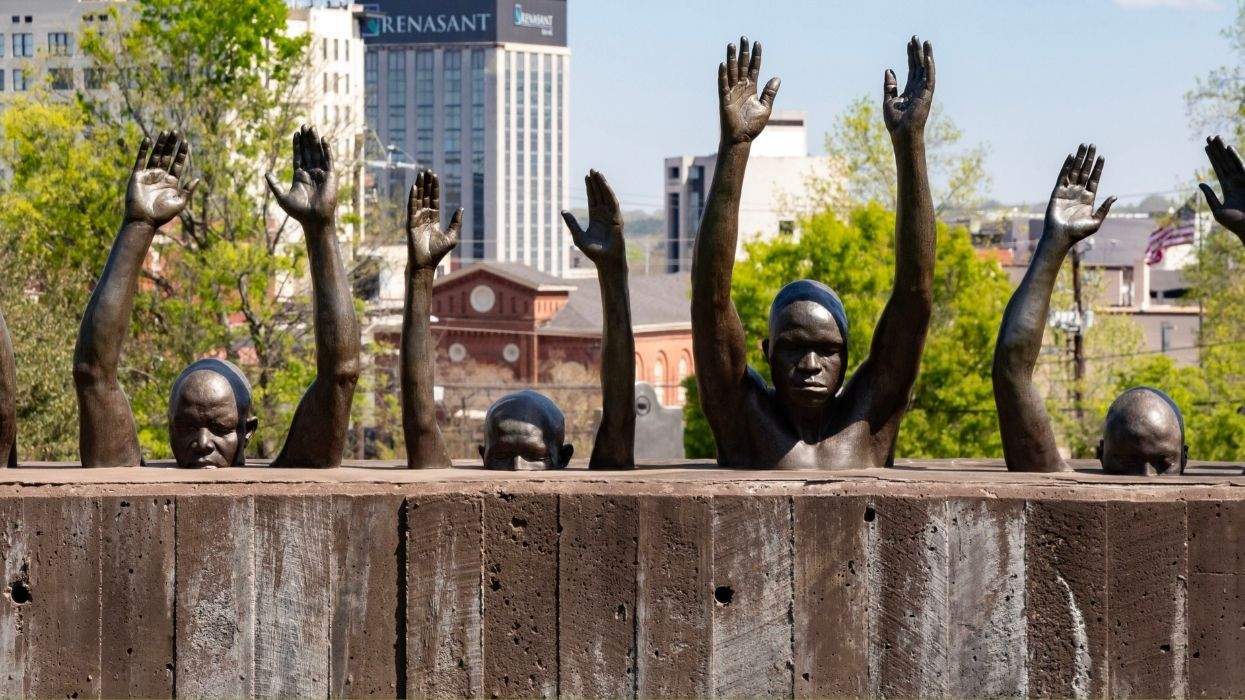

I’m not dismissing the very real economic factors shaping many queer people’s lives right now. Rent in cities has rapidly outpaced wage growth. Food prices have soared while nutritional quality has tanked. And if one more historic gay bar gets gentrified into a gastropub or bought out by private equity demons (worse than demon twinks, IMO), I will fling this gahdamn chair across the room. We have plenty of financial headwinds to bitch about at the moment.

But there are ways we self-sabotage our money too. Some of it traces back to consumerism, now a century in the making, in which companies and entire industries market to you not only on a product’s features and benefits but also what using that product means about you as a person. Consumerist programming can be fun (bought my first leather harness last year!), but it sometimes seeps into our unconscious and lures us down a mindless path of working hard and spending harder until we become rich in material things yet still hollow in identity and purpose.

There’s also the connection between mental health and money, which is often ignored entirely despite being a huge factor to our financial well-being. This one is especially important for queer people because we often encounter minority stress, defined by researchers as “the resultant conflict with the social environment experienced by minority group members.” To cope with all this, we often resort to behaviors like avoidance, numbing, and retail therapy, all of which deliver short-term relief but only worsen economic anxiety in the long run. This is in addition to actual financial blockers like discrimination that blunt our employment and earning potential.

It’s a gnarly jab-jab-hook (er … duckwalk-spin-dip?) that makes personal finance a slippery slope for a lot of queer people, and recent research backs this up. Eighty-seven percent of queer people make less than $100,000 a year, and over half make less than $50,000, according to research from the Center for LGBTQ Economic Advancement & Research. This research also revealed we’re twice as likely as straight and cisgender people to be unemployed and 45 percent more likely to have over $75,000 in student loans.

Queer life can feel kinda hopeless these days. But, um … hasn’t it always? And haven’t we persevered, risen above the bullshit, and created cultures and communities in times of struggle— and wealth? By educating ourselves on the basics of money and how to integrate it into our queer lives, we can better ensure we’re able to support ourselves in times of political and religious oppression. I make a heartfelt joke about this in my book’s introduction: “Our queer ancestors would not have wanted us to carry around the chronic stress that is worrying constantly about money — not even as a handbag.” This stuff’s important, y’all, which is why a publisher bought a how-to book about it for people like us.

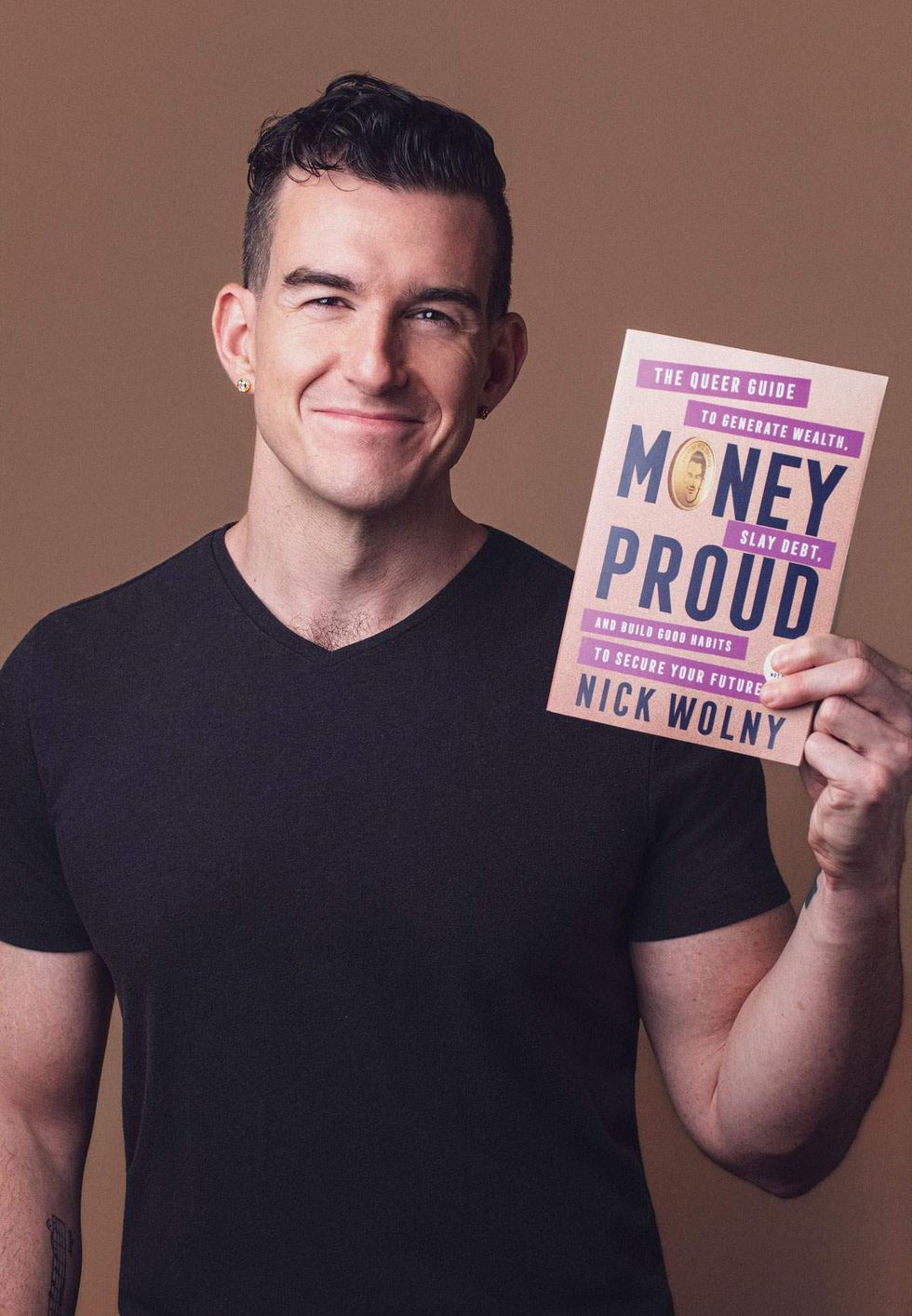

In Money Proud, I distill your most actionable money moves down into something called the seven-word plan: Lower expenses, increase earnings, invest the difference. Shut out all the economic bluster and focus on these three aspects of the seven-word plan to get your money back on track this year.

Lower Expenses

Expenses tend to creep up throughout the year and especially during the holidays, so now is a great time to review your spending and recommit.

Stop avoiding your budget or bank account balances. We can’t beat fascism if we’re too scared to look at how many times we went to Starbucks last month. Take a deep breath, relax your forehead (also helps with wrinkles), and come out to yourself about your spending habits.

It’ll be nice if you can pull back a few bucks here or there from this audit. But I’m more interested in you looking at what you’re spending your money on and why. Which expenditures light you up and move you more toward your goals? Which ones are just you numbing out because your annoying work colleague said something stupid on Slack (again)? Don’t let the latter siphon away your hard-earned coins via another numbing episode.

By spending on things that support your overall well-being, you start to close the satisfaction gap, the very thing consumerism and capitalism rely on to keep you compliant.

Increase Earnings

Once you’ve regained your bearings on where the hell all your money is going, turn your attention to what will probably be your most lucrative financial to-do: making more money.

This doesn’t have to mean more work, though that’s a common option, with between 28 and 45 percent of Americans having a side hustle. It could also mean dusting off your résumé and pursuing a better-paying job. Assess three scenarios: making more money from your current income source, making more money from a different income source, or making more money by creating an income source.

This might mean being honest with yourself about your industry, whether you see yourself in it long-term and whether you really need to bring your passions to work. Always strive to escape shitty and/or discriminatory work environments. Also be thoughtful about the idea of skill transfer. Your skills in hospitality or the arts might transfer into lucrative industries more easily than you realize. If you’re not sure, consider taking a community college class that can help you reskill and figure it out. What comes naturally to you might be a coveted competency to others.

Having been a consultant since 2016, I admit I have a bias for entrepreneurship as a way to speed up your income growth. Being the boss ain’t easy (though you get to walk the talk with regard to executive realness), but if you know what you offer has value, being self-employed means all the growth and equity goes back in your pocket.

Invest the Difference

As you widen the gap between income and expenses, you’ll create a leftover pool of money each month. I suggest investing this money in a balance of assets that help you secure your future and experiences that enrich your life in the present.

The stock market is often emotional; it’s in the news constantly because emotions are good for ratings (gestures to any Housewives franchise). But know that many, many people simply set it and forget it when it comes to investing money and saving for retirement. It’s easy to sign up for automatic transfers and let compound interest do the rest, and although the market goes up and down from year to year, it’s historically delivered strong returns in the long run.

Done with capitalism? You can always put your money in safer investments or community initiatives instead. There are also sites like Weapon Free Funds that help you find stock market options better aligned with your ethics and values. But to leverage any of this, you have to have extra money in the first place, which is why lowering expenses and increasing income can take up most of your financial time and attention.

Last, remember to have fun along the way. You should be practicing retirement now and occasionally cosplay as a full-time relaxer so that when the real thing eventually comes around, you already know how you prefer to spend your leisure time (and have people in your life to share it with). I recommend creating a sinking fund or vacation fund; this is a separate savings account where you can stow your blow money. Then, when it comes time for that orgasmic splurge, you’ll already have the cash in hand.

“Rich in the mind, that’s why I’m making deposits,” crooned Tierra Whack on Beyoncé’s “My Power,” dropping both beats and holistic wealth wisdom in a two-for-one deal. She’s right. The quest to master your money often starts with a mental reset. From there, seek out ways to transfer clarity into action so you can cultivate a queer life you love.

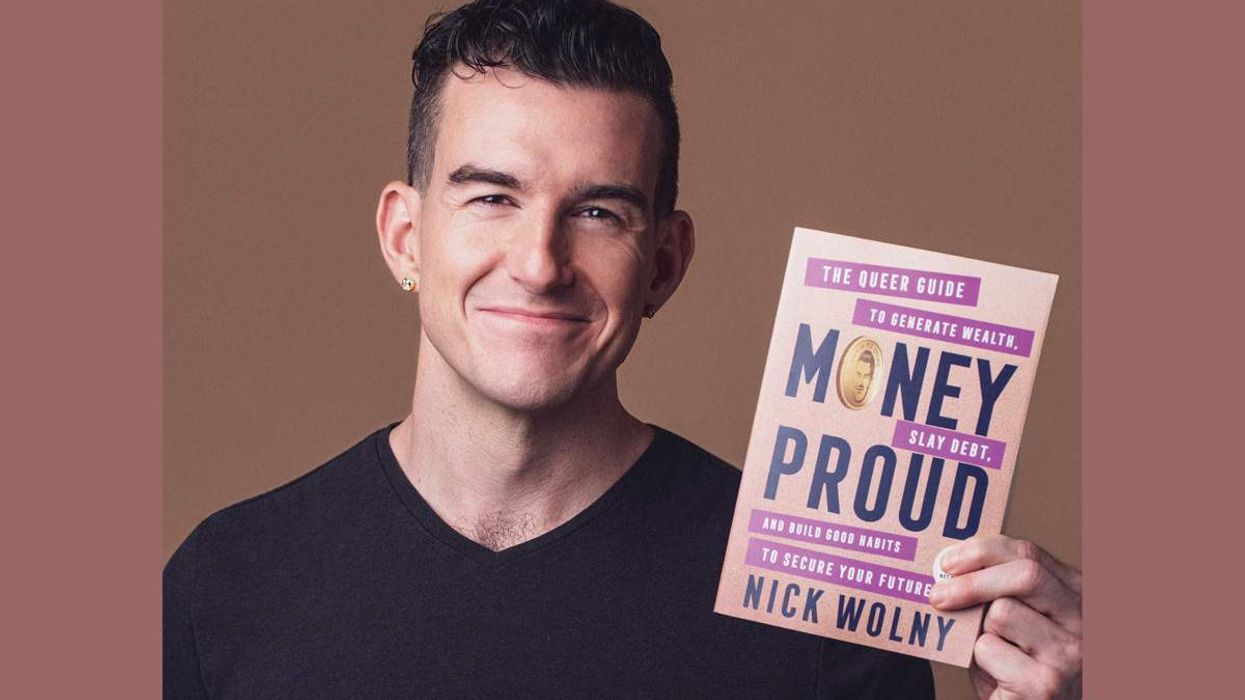

Nick Wolny is Out magazine’s finance columnist. He writes Financialicious, a personal finance newsletter tailored toward queer readers, and his first book, Money Proud: The Queer Guide to Generate Wealth, Slay Debt, and Build Good Habits to Secure Your Future, is available now. nickwolny.com @nickwolny

Jan-Feb 2026 issue of OUT

This article is part of OUT's Jan-Feb 2026 issue, which hits newsstands January 27. Support queer media and subscribe — or download the issue through Apple News+, Zinio, Nook, or PressReader.