In a Sunday night 60 Minutes interview with Anderson Cooper, Rep. Alexandria Ocasio-Cortez made some matter-of-fact statements that conservatives are dishonestly trying to spin as "extreme."

Ocasio-Cortez's straightforward interview is what apparently passes for spicy now in white bread America: In it, she accurately called Trump "racist" and suggested legislators levy a 70 percent top marginal tax rate on ultra-rich Americans to help pay for the Green New Deal and other progressive social initiatives.

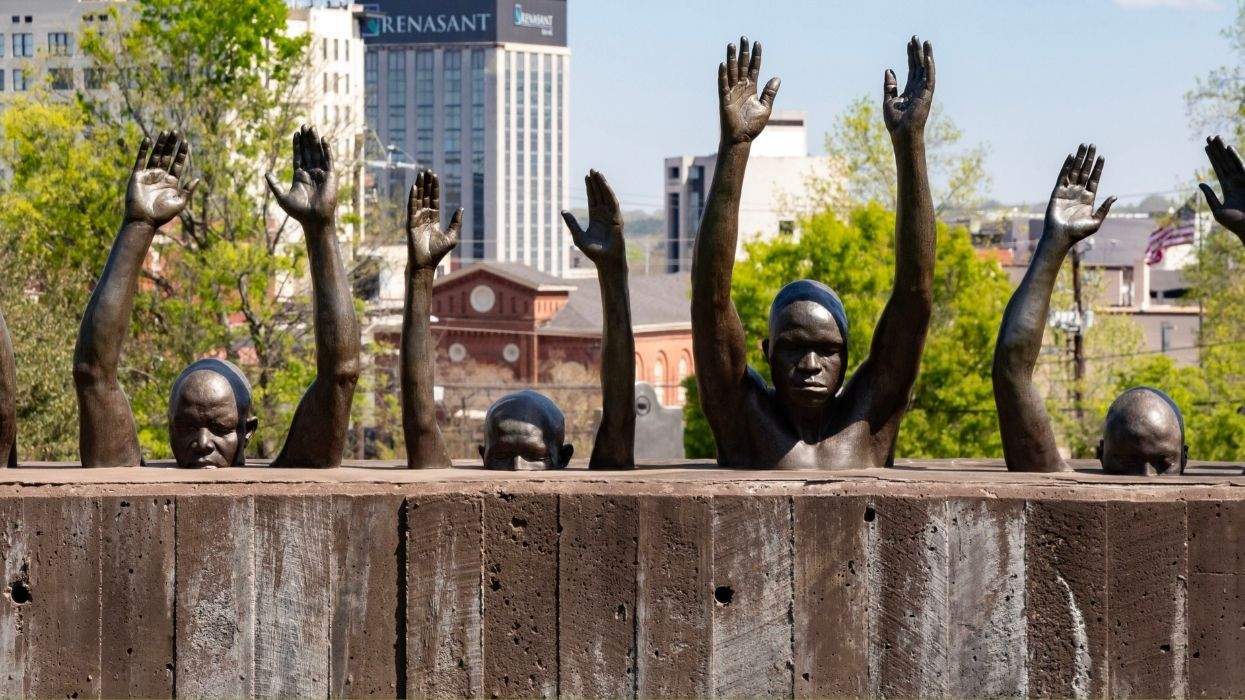

Surprisingly, her calling Trump a racist doesn't seem to have upset too many conservatives, probably because he has proven his racist cred again and again: He has called Mexican immigrants "rapists and drug dealers," sought to ban all Muslims from entering the US, claimed Mexican judges can't be impartial, called black NFL protestors "sons of bitches" and Neo-Nazi protestors at the 2017 Charlottesville Unite the Right rally "very fine people." He also claimed former President Barack Obama was secretly born in Kenya and pardoned former Arizona Sheriff Joe Arpaio despite his years of racial profiling.

These are only the most glaring examples, but there are plenty of others. Trump is racist and so racists love him.

But Ocasio-Cortez's comments about the marginal tax rate have predictably riled conservatives, most notably House Minority Whip Steve Scalise of Louisiana and influential anti-tax lobbyist Grover Norquist. Both men claimed via Twitter that Ocasio-Cortez wants to take 70 percent of everyone's income for funding "leftist fantasy programs."

But their comments are a deliberate mischaracterization of her plan and depend wholly on public ignorance about what the marginal tax rate actually is.

The marginal tax rate, according to Investopedia, is "a method of taxation [that] aims to fairly tax individuals based upon their earnings, with low-income earners being taxed at a lower rate than higher income earners." As such, the marginal tax rate for an individual increases as their income rises.

In the interview, Ocasio-Cortez herself clarified that the 70 percent rate would only affect those among us who make more than $10 million a year. As such, her plan would affect about 16,000 people -- or approximately the top 0.05 percent of all Americans -- and could bring in $72 billion of federal revenue annually. But, of course, the super-rich always find loopholes.

Nonetheless, the top marginal tax rate is currently 37 percent and it only applies to individuals and couples who make more than $510,300 and $612,350 annually, respectively. Yes, you read that right: people who make 10 to 50 times more than that, all still pay the same tax rate. Bonkers.

Ocasio-Cortez's Green New Deal, her signature initiative as a new congressperson, includes an ambitious set of proposals like making America 100 percent reliant on renewable energy, reducing greenhouses gases, fixing our infrastructure, and ensuring the poorest and most marginalized communities financially benefit from it.

Renewable energy physicist Christopher Clack estimates that transitioning the nation wholly to renewable energy would cost at least $2 trillion, so it'd take several decades for her hypothetical tax plan to solely, completely fund the New Green Deal.

The 1930s New Deal (which you may recall as the Depression-era economic recovery program started by Democratic President Franklin D. Roosevelt) was paid for out of government deficit rather than new taxes. Once its investments began to pay off, it essentially funded itself. If managed correctly, the New Green Deal could potentially do the same.

But regardless, conservatives acting like hers is a "radical" new plan would do well to look back in time. The top marginal tax rate has been more than 70 percent in the past.

During the '50s and early '60s, Republican President Dwight Eisenhower had top earners paying a 91 percent top marginal tax rate. Democratic Presidents John Kennedy and Lyndon B. Johnson followed with a 70 percent top marginal tax rate. It fell to 50 percent with Republican President Ronald Reagan's first big tax cut in 1982 and then a national tax reform bill lowered it to around its current level of 38 percent four years later.

Modern economists like MIT's Peter Diamond, Berkeley's Emmanuel Saez, Paris School of Economics' Thomas Piketty and Harvard's Stefanie Stantcheva all agree that it makes more sense to tax ultra-wealthy Americans who won't miss the extra money rather than squeezing poorer ones who will.

The idea that we should tax wealthy Americans more isn't radical. In fact, several recent polls show that about 60 percent of Americans say the wealthy should pay more taxes. What would be radical is if conservatives evaluated progressive initiatives on their actual merits rather than spinning them as a "leftist fantasy."